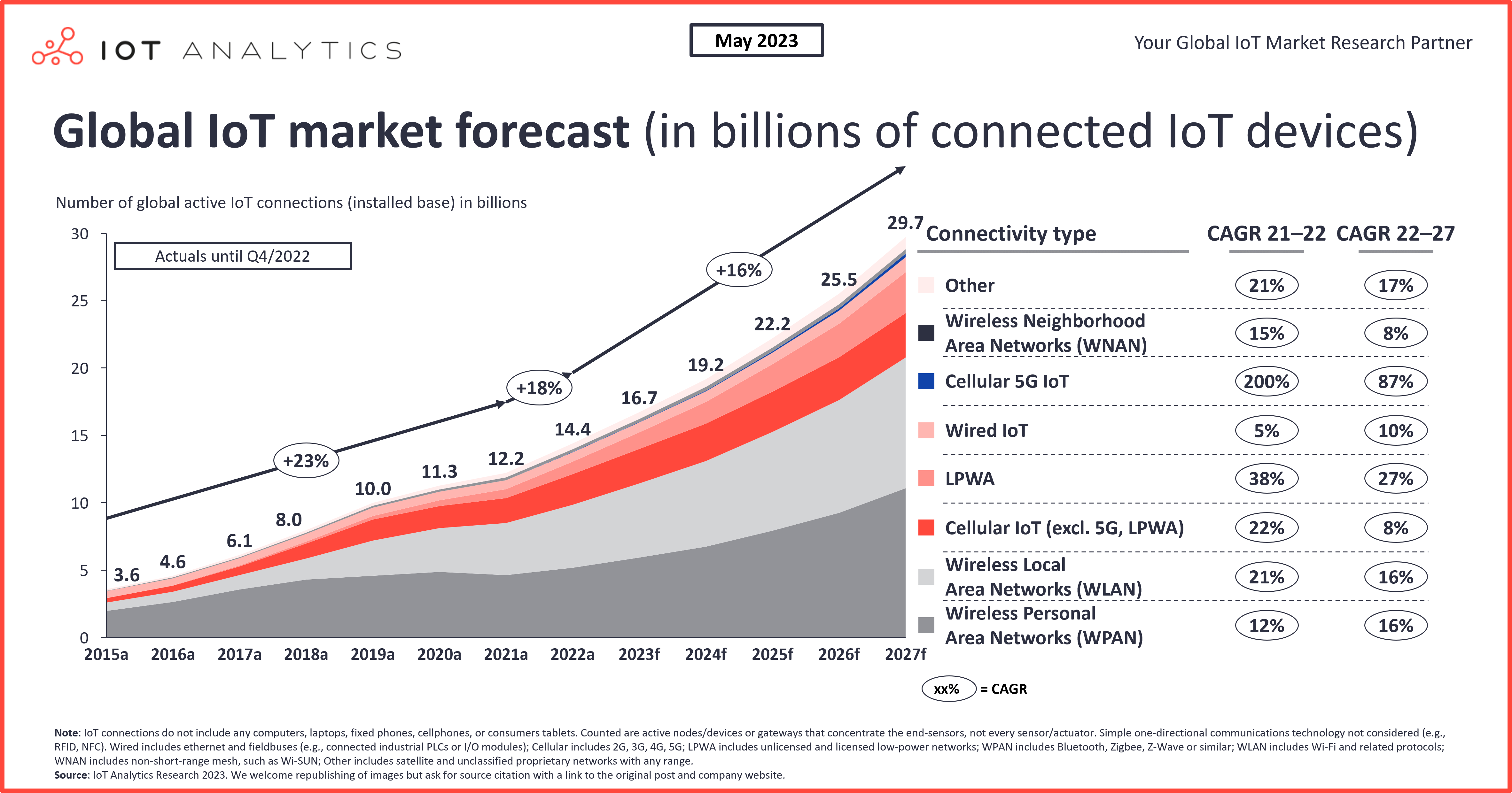

IoT connections market update—May 2023

The number of global IoT connections grew by 18% in 2022 to 14.3 billion active IoT endpoints. In 2023, IoT Analytics expects the global number of connected IoT devices to grow another 16%, to 16 billion active endpoints. While 2023 growth is forecasted to be slightly lower than it was in 2022, IoT device connections are expected to continue to grow for many years to come.

IoT connections forecast

By 2027, there will likely be more than 29 billion IoT connections. Compared to the last IoT device market update a year ago.

Lowering the five-year IoT market outlook for two important reasons:

1. Chipset supply to remain constraint for years to come in the face of surging demand

Chipset supply chains have considerably improved in 2023 as demand has weakened in the face of a slowing economy. Despite the demand slump, current chip lead times remain elevated compared to pre-COVID-19 levels. It is believed that once the economy recovers and a new demand wave kicks in, chipset supply will become much more constraint again. While it is true that a lot of chip manufacturing capacity is being planned , fueled by government initiatives such as the US Chip and Science Act (2022) and the EU Chips Act (2022), it may take many years until supply matches or surpasses demand for the majority of different types of chipsets.

Make no mistake, the investments into new chip manufacturing capacity are enormous. TSMC has increased its capital expenditure from approximately $15 billion in 2019 to $42–$44 billion in 2022. Similarly, in 2023, Samsung announced that it plans to invest $230 billion in South Korea over the next 20 years to build new chip production capacity. However, these investments take time to materialize. Semiconductor plant constructions typically take three to four years to complete, and it can take another three to four years for facilities to reach full capacity.

2. China uncertainties

In the last years, China was the leading country for new IoT device connections, with active cellular IoT connections in China alone surpassing two billion in 2022. However, the high growth years may be coming to an end with the country facing a number of issues, including technological supply shortages on the back of renewed US–China trade tensions, most notably in the semiconductor industry. In October 2022, the US placed an export ban on China, causing significant disruption to these industries. Consequently, chip companies are relocating their facilities outside of China. Some companies, such as Infineon, TSMC, AMAT, and ASML, have announced that they are moving parts of their production out of China.

The leading IoT connectivity technologies: three technologies making up nearly 80% of the market

Global IoT connectivity is dominated by three key technologies: Wi-Fi, Bluetooth, and cellular IoT.

- Wi-Fi. Wi-Fi makes up 31% of all IoT connections. In 2022, more than half of Wi-Fi-enabled devices shipped worldwide were based on the latest Wi-Fi 6 and Wi-Fi 6E technologies, which promise faster and more reliable wireless connectivity. The adoption of these technologies has made communication between IoT devices more efficient, leading to improved user experiences and overall performance. Wi-Fi technology is leading IoT connectivity in sectors such as smart homes, buildings, and healthcare.

- Bluetooth. 27% of global IoT connections rely on Bluetooth. Bluetooth Low Energy (BLE), also known as Bluetooth Smart, has been continuously developed to allow IoT devices to maintain reliable connectivity while consuming limited power. As a result, BLE is now the preferred option for battery-powered IoT devices such as smart home sensors and asset tracking devices. Even the industrial sector is starting to show increasing interest in IO-Link Wireless technology, which is based on IEEE 802.15.1 (the technical standard for Bluetooth) and allows for wireless communication between sensors/actuators and an I/O master.

- Cellular IoT. Cellular IoT (2G, 3G, 4G, 5G, LTE-M, and NB-IoT) now makes up nearly 20% of global IoT connections. Global cellular IoT connections grew 27% YoY in 2022, strongly surpassing the growth rate for global IoT connections. This growth is due to the adoption of newer technologies such as LTE-M, NB-IoT, LTE-Cat 1, and LTE Cat 1 bis, as older technologies such as 2G and 3G are phased out. Although 5G module shipments also grew more than 100% YoY in 2022, the growth rate is still slower than many had expected. In 2023, the top five network operators—China Mobile, China Telecom, China Unicom, Vodafone, and AT&T—managed 84% of all global cellular IoT connections. In terms of IoT revenue, the top five network operators make up 64% of the IoT network operator market, with China Mobile, AT&T, Deutsche Telekom (including T-Mobile), China Unicom, and Verizon leading the market.

The analysis shows a few notable shifts over the years, for example:

- China Mobile jumped from fifth place in 2012 to first place in 2021 and is expected to remain there in the foreseeable future.

- AT&T, Verizon, and Deutsche Telekom have consistently ranked in the top five from 2010 to 2022 and are expected to maintain their positions through 2027.

- China Unicom joined the top five in 2022 and is projected to remain among the leading network operators through 2027.

IoT connectivity trends to look out for

While the general IoT connectivity landscape only changes slowly (e.g., some devices remain connected for a decade or even longer), new IoT connectivity technologies do have an impact on the landscape in the long run. Here are two interesting developments:

1. LPWAN technology convergence

In 2022, the LPWAN industry saw two significant events that shifted the focus from competition among LPWAN connectivity technologies to co-existence and convergence of those technologies. UnaBiz‘s acquisition of Sigfox and Semtech’s acquisition of Sierra Wireless paved the way for LPWAN companies to provide multi-connectivity of several LPWAN technologies at the same time. To make this convergence happen and be able to deploy any LPWAN technology, UnaBiz, for example, now collaborates with The Things Industries, Actility, Soracom, LORIOT, and others. This means that UnaBiz has become more than just a technology provider but rather a solution provider that also bundles all different technologies and orchestrates them on their own software platform. UnaBiz is just one example that shows how the industry is shifting from a single LPWAN technology view to a multi-connectivity solution view.

We anticipate that this LPWAN convergence may lead to the emergence of new multi-LPWAN connectivity modules in the future that would provide end-to-end connectivity in verticals such as logistics and mobility.

2. LEO-based satellite IoT connectivity

LEO satellite connectivity for IoT is gaining popularity because it provides extensive coverage, minimal delays, and strong reliability. The technology is especially useful in the agriculture, maritime, and logistics industries. LEO satellites are closer to Earth than traditional satellites, resulting in reduced latency and faster data transmission, which are essential for real-time data processing. This type of connectivity is more resilient and reliable, ensuring consistent communication, even in challenging environments or during natural disasters. Advancements in LEO-based IoT satellite connectivity continue to optimize performance and enhance the user experience.

Satellite IoT connections are expected to grow from six million to 22 million between 2022 to 2027, at a CAGR of 25%. While this growth is expected to have a minor effect on the overall market, the integration of satellite connectivity options into LPWA chipsets by companies like Qualcomm could accelerate adoption. Sony Semiconductor already launched ALT1350, the first cellular IoT LPWA chipset to offer satellite connectivity, which opens up new possibilities for IoT devices to communicate beyond traditional network boundaries. This integration of satellite connectivity into LPWA chipsets is expected to drive further innovation and growth in the IoT market.

1. Predominantly positive IoT sentiment going into the second half of 2023

Despite a number of macro uncertainties and some (IoT-related) layoffs, the IoT market remains largely intact going into the second half of 2023. Most market participants have a predominantly positive outlook, with industrial IoT projects and Industry 4.0 initiatives driving the market.

Below are some recent representative quotes from chip companies with a focus on IoT:

“We continue to secure major greenfield design wins, even amid macro uncertainty. The IoT market has incredible potential, with thousands of new applications on the horizon.”

Matt Johnson – President & CEO, Silicon Laboratories (1 February 2023)

“The industrial IoT markets are performing better than our expectations.”

Kurt Sievers – President & CEO, NXP Semiconductors (31 January 2023)

2. IoT platforms market is consolidating

Several major companies that were selling IoT platforms recently announced discontinuations, including Google’s IoT Core, Bosch‘s IoT Device Management, IBM’s Watson IoT Platform, and SAP’s IoT services. The reasons for the strategic shift away from IoT vary. The market dominance of Microsoft Azure IoT and AWS IoT in “generic” IoT platforms certainly played a role, in conjunction with the “the lack of profitability” in the offered IoT services. Several of these companies have announced a shift toward creating solutions specific to particular verticals or relying more on a few select partners to continue to support IoT initiatives (e.g., Google–Litmus Automation partnership).

“IoT services themselves don’t make enough money. The services like AWS IoT Core and Azure IoT Hub are expensive to build and maintain and by themselves they are likely not profit-making.”

Former IoT Product Lead, Microsoft

3. IoT-focused start-ups are struggling to secure funding

The amount of money invested in global IoT start-ups decreased significantly in the last 12 months. In the first quarter of 2023, it was noted 52 IoT-related funding rounds totalling $840 million, a 45% reduction in the value of investment in IoT start-ups companies compared to Q1/2022.

Some of the larger recent IoT-related funding rounds include a $150 million Series D for US-based chipset manufacturer Astera Labs in November 2022 and a $43 million Series C for China-based connectivity chipset company XINYI Information Technology in March 2023.

https://iot-analytics.com/number-connected-iot-devices/